Group Insurance - FSSS (CSN)

Home Childcare Providers (RSGE)

We are proud to insure you as a home childcare provider (RSGE) affiliated with the FSSS (CSN), and to make this hub of information available to you! It includes all the details about your group insurance plan.

What you need to know

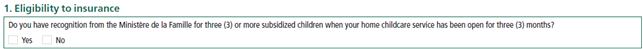

To be eligible for the group insurance plan, you must be recognized as a permanent home childcare provider by the Ministère de la Famille and care for three or more children in your home daycare.

Once you meet these two criteria, you are eligible three months after you have received Ministère de la Famille recognition.

You must sign up for group insurance once you are recognized as eligible.

You must fill out the enrolment form and return it to us within 30 days following the date you become eligible.

You must fill out the enrolment form and return it to us within 30 days following the date you become eligible.

Attach a "void" cheque to your form.

Send your enrolment form and "void" cheque to us in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec (Québec) G1V 4H6

When your application is submitted to us within the 30 days following your eligibility date: your application for insurance is accepted as of your eligibility date.

When your application is submitted to us more than 30 days after your eligibility date: your application for insurance is accepted on the first day of the 14-day premium payment period that coincides with or follows the date on which Beneva received your application. Some of your selections may be subject to evidence of insurability.

- Confirm that you are recognized by the Ministère de la Famille.

-

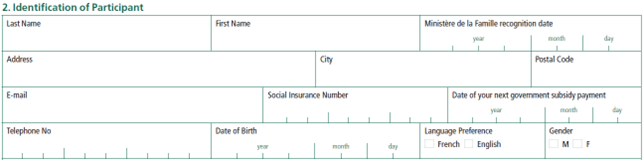

Specify all elements that allow us to identify you.

-

Also indicate the date on which you were recognized by the Ministère de la Famille and the date on which your next government contribution is paid.

-

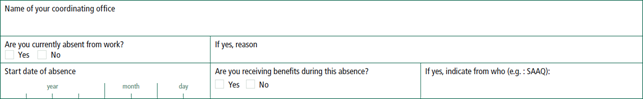

Then identify your coordinating office and specify your employment situation.

-

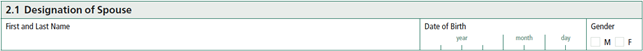

Identify your spouse (if applicable).

-

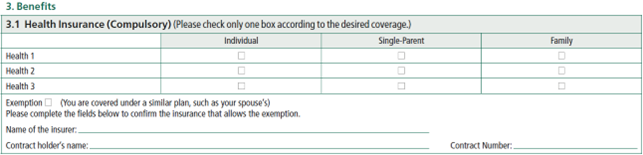

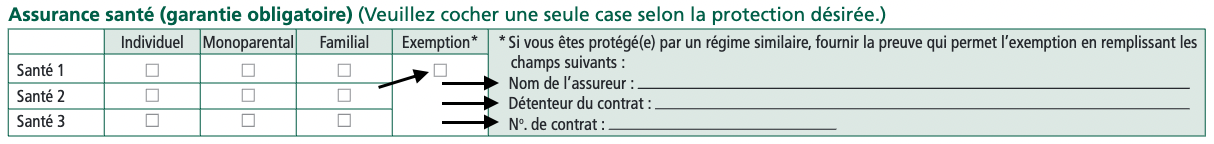

Make your health insurance coverage selection.

-

As needed, see “Your plan at a glance” in the Documentation section to find out more about each level of coverage.

-

If you want to opt out, make sure you provide all of the information requested.

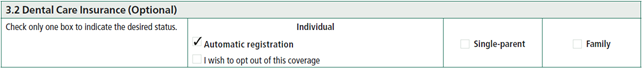

- Specify your choice of status for dental care.

- Please note:

- Individual status is assigned automatically.

- You must check “I wish to opt out of this coverage” if you don’t want to sign up for this benefit.

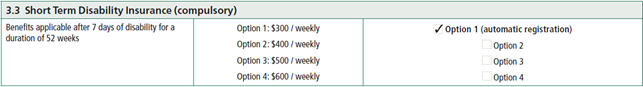

- Select your short term disability insurance coverage.

- Please note:

- Option 1 ($300) is assigned automatically and at the time you enrol, the four options available are offered to you without evidence of insurability.

- Subsequently, any request to increase this coverage is subject to evidence of insurability.

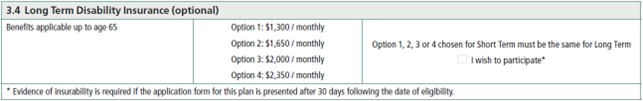

- You can subscribe to long term disability insurance without providing evidence of insurability.

- Please note:

- If you sign up for this benefit, the option is assigned as the same as for short term disability insurance.

- Subsequently, any request to add this coverage is subject to evidence of insurability.

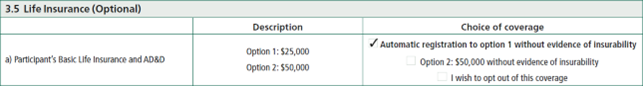

- For Participant’s Basic Life Insurance and Participant’s AD&D Insurance, you can select Option 1 ($25,000) or Option 2 ($50,000) without providing evidence of insurability.

- Please note:

- Option 1 ($25,000) is assigned automatically.

- You must check “I wish to opt out of this coverage” if you don’t want to sign up for this benefit.

- Subsequently, any request to add or increase this coverage is subject to evidence of insurability.

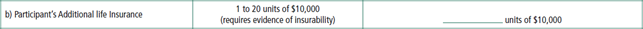

- You can apply to enrol in Participant’s Optional Life Insurance.

- Please note:

- This coverage is always subject to evidence of insurability.

- You must first sign up for Participant’s Basic Life. Insurance plus Participant’s AD&D Insurance Option 2 ($50,000).

- You can subscribe to Spouse’s and Dependent Children’s Life Insurance without evidence of insurability.

- Please note:

- This benefit is granted automatically.

- You must check “I wish to opt out of this coverage” if you don’t want to sign up for this benefit.

- Subsequently, any request to add this coverage is subject to evidence of insurability.

-

You can apply to enrol in Spouse’s Optional Life Insurance.

- Please note:

- This coverage is always subject to evidence of insurability.

- You must first sign up for Participant’s Basic Life. Insurance plus Participant’s AD&D Insurance Option 2 ($50,000).

-

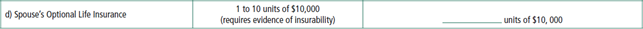

If you subscribe to life insurance for yourself, you must designate a beneficiary.

-

Three steps:

1. Choose either your estate or a designated beneficiary.

2. If you are naming a beneficiary, specify your relationships with that beneficiary.

3. Specify whether the beneficiary is revocable or irrevocable.

-

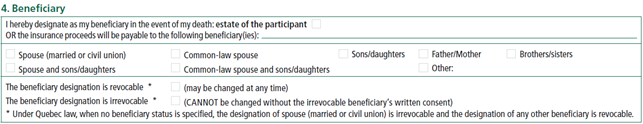

If you want to sign up for the optional life insurance for yourself or your spouse and you are a non-smoker, you must declare this information in order to receive a lower premium.

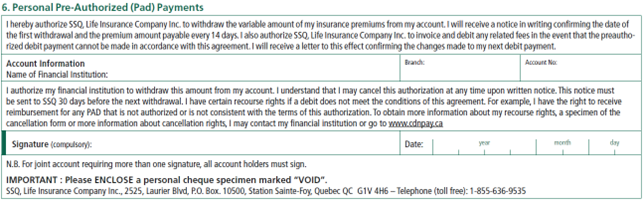

- Premiums are paid by means of preauthorized debit payments.

- You must:

- Provide your bank account details.

- Provide a cheque marked "void".

-

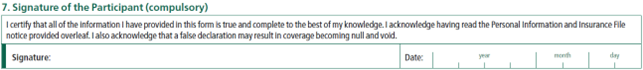

Then, sign the enrolment form and send it to us along with your "void" cheque.

-

Send your enrolment form and "void" cheque to us in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

The following benefits are compulsory:

- Health 1 – Individual status (subject to an exemption entitlement)

- Short term disability insurance

If no choice is made, the benefits below are granted automatically:

- Health 1 – Individual status

- Dental Care – Individual status

- Short term disability insurance – Option 1 ($300)

- Participant’s Basic Life Insurance + Participant’s AD&D Insurance – Option 1 ($25,000)

- Spouse’s and Dependent Children’s Basic Life Insurance

Enrolment in the benefits below is subject to a minimum participation period of 36 months:

- Health 2

- Health 3

- Dental Care

- The only payment method accepted is preauthorized debit.

- The debit is taken every 14 days on the day your government contribution is paid.

- Your 14-day premium periods start on the day of your debit.

- If we are unable to take the debit for your premium for two consecutive premium periods:

- your certificate will be terminated

AND - a letter of non-payment will be sent to the Régie de l’assurance maladie du Québec (RAMQ)

- your certificate will be terminated

Description :

Several benefits are offered depending on the coverage level you choose (Health 1, Health 2 or Health 3), giving you access to the health care and services that meet your needs:

- Prescription drugs:

- Health 1: RAMQ list + $5.00 deductible per prescription drug purchase + 67% reimbursement

- Health 2: Regular list + $5.00 deductible per prescription drug purchase + 75% reimbursement

- Health 3: Regular list + $5.00 deductible per prescription drug purchase + 80% reimbursement

Specifications Regarding Drug Reimbursement:

If an insured chooses to purchase an eligible innovative drug instead of any existing generic equivalent, the amount of reimbursement will be determined in accordance with its lowest cost generic equivalent.

The amount that is included in the annual out-of-pocket is the one the insured would have paid should they have bought this lowest cost generic equivalent.

However, it is possible to obtain a reimbursement based on the cost of the innovative drug that cannot be substituted for medical reasons by submitting the appropriate form duly completed by the attending physician, provided we approve the request.

To be eligible, drugs must be available only by medical prescription.

- Travel Insurance

- Other Medical Expenses

- Health Care Professionals

- Vision Care

- This benefit is compulsory, subject to the exemption entitlement.

- The available coverage statuses are:

- Individual

- Single-parent

- Family

- IMPORTANT: Note that Quebec’s Act respecting prescription drug insurance requires people who are insured by a private health insurance plan to cover their spouse and dependent children if they are not already covered by another private health insurance plan.

- You must select one of the coverage levels: See the “Your plan at a glance” brochure to learn the coverage offered at each level.

- Health 1

- Health 21

- Health 31

1 If you select Health 2 or Health 3 coverage, you must maintain your participation for at least 36 months before you can request to decrease your coverage level.

Description:

An excellent complement to health insurance, dental care insurance adds several benefits to your group insurance, including:

- Basic Dental Care

- Restorative Dental Care

- This benefit is optional, but with automatic enrolment.

- The benefit is automatically granted with Individual status unless otherwise indicated on the enrolment form.

- The available coverage statuses are:

- Individual

- Single-parent

- Family

- If you choose this benefit, you must maintain your participation for at least 36 months before you can request to decrease your coverage level.

Description :

This benefit is automatically included in your contract. In the event of personal issues that may affect your normal functioning or that of one of your dependents, support, consultation, counselling and intervention services are available through the Assistance Program. Coverage is limited to 9 hours of services per calendar year for all insured members of the same family.

Description :

In the event of disability, this coverage provides you with weekly benefits during your first year of disability.

- This benefit is compulsory.

- Benefits start: After 7 days of disability

- Benefits end: After 52 weeks of disability or at age 65

- You must choose one of the following four options:

- Option 1 ($300 per week, non-taxable)

- Option 2 ($400 per week, non-taxable)

- Option 3 ($500 per week, non-taxable)

- Option 4 ($600 per week, non-taxable)

Description:

In the event of long term disability, this coverage provides you with monthly benefits subsequent to the short term benefits which end after 52 weeks of disability or at age 65.

- This benefit is optional.

- Benefits start: After 52 weeks of disability

- Benefits end: At age 65.

- If you opt to enrol, your level of benefits (Option 1, 2, 3 or 4) will be the same as with the short term disability insurance.

- Option 1 ($1,300 per month, non-taxable)

- Option 2 ($1.650 per month, non-taxable)

- Option 3 ($2,000 per month, non-taxable)

- Option 4 ($2,350 per month, non-taxable)

- This benefit is available without evidence of insurability when you submit your enrolment form within 30 days following the date you are eligible for group insurance.

- Any request to add or increase this benefit beyond the 30 days following the date you are eligible will require evidence of insurability.

Description:

The two benefits described below are inseparable.

Participant’s Life Insurance

In the event of your death, this option provides the beneficiary you designated with $25,000 or $50,000.

Participant’s Accidental Death and Dismemberment (AD&D) Insurance

In case of accidental death or accidental loss of a limb, you or your designated beneficiary will receive a certain percentage of the amount of $25,000 or $50,000 you chose, without exceeding 100%.

- This benefit is optional, but with automatic enrolment.

Coverage Option 1 ($25,000) is granted automatically unless otherwise indicated on your enrolment form. - You must choose a coverage level:

- Option 1 ($25,000)

- Option 2 ($50,000)

- All the options are available without evidence of insurability when you submit your enrolment form within 30 days following the date you are eligible for group insurance.

- Any request to add or increase this benefit beyond the 30 days following the date you are eligible will require evidence of insurability.

Description:

This option allows you to add between $10,000 and $200,000 to the Participant’s Basic Life Insurance coverage.

- This benefit is optional.

- You can choose from 1 to 20 units of $10,000.

- To enrol, you must first sign up for Participant’s Basic Life Insurance and AD&D Insurance Option 2 ($50,000).

- Any request to add or increase this benefit is subject to evidence of insurability.

Description:

This option allows you to receive an amount of $5,000 subsequent to the death of a dependent.

However, this amount is $10,000 in the event of the death of a child if you have no spouse at the time the death occurs.

- This benefit is optional, but with automatic enrolment. This benefit is granted automatically unless otherwise indicated on your enrolment form, regardless of the health insurance coverage status you select.

- This benefit is available without evidence of insurability when you submit your enrolment form within 30 days following the date you are eligible for group insurance.

- Any request to add this coverage beyond the 30 days following the date you are eligible will require evidence of insurability.

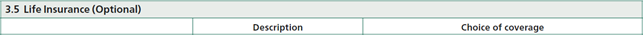

Description:

This option allows you to add between $10,000 and $100,000 to the Spouse’s Basic Life Insurance coverage.

- This benefit is optional.

- You can choose from 1 to 10 units of $10,000.

- To enrol, you must first sign up for Participant’s Basic Life Insurance and AD&D Insurance Option 2 ($50,000).

- Any request to add or increase this benefit is subject to evidence of insurability.

How to make a claim

Need to make a claim?

Four ways to choose from.

Online

Submit your claim with your Client Centre and get reimbursed in 48 hours for most benefits.

The mobile app

Download the free Beneva mobile application and get reimbursed in 48 hours for most benefits.

Application mobile disponible sur l'Apple App Store

Application mobile disponible sur l'Apple App Store  Application mobile disponible sur le Google Play Store

Application mobile disponible sur le Google Play Store

By mail

Send us the claim form along with the original receipts. Personalized forms are available in Client Centre. Simply fill them out, print and sign.

You can't find the form you're looking for on the list? Call our Client Service.

1 888 651-8181

With the insurance card

Present your insurance card at the dentist's office or at the pharmacy. You will pay only for the expenses not covered under your group insurance contract.

IMPORTANT: All health insurance claims must be received by us no later than 12 months after the date the expenses were incurred. After that, they will not be reimbursed.

Want to know whether the medical expenses you incurred are eligible for reimbursement?

The Expenses Covered feature lets you go to a specific benefit to see the applicable terms of reimbursement.

Easily access this information by clicking on the shortcut Check covered medical expenses or Check covered dental care expenses on the Client Centre homepage.

Your insurance booklet provides detailed information on your coverage.

IMPORTANT: All health insurance claims must be received by us no later than 12 months after the date the expenses were incurred. After that, they will not be reimbursed.

The easiest way to have your drugs reimbursed is to show your insurance card to your pharmacist.

The pharmacist can submit the claim to us directly and charge you only your deductible and coinsurance.

For any other situation involving a drug claim, please see Section 8 of your booklet – How to submit claims.

IMPORTANT: All health insurance claims must be received by us no later than 12 months after the date the expenses were incurred. After that, they will not be reimbursed.

TRAVEL INSURANCE AND ASSISTANCE

In the event of an emergency that occurs while the insured is out of their home province, all travel assistance services and most eligible travel insurance expenses are handled by our travel assistance service, as long as the insured contacts them.

However, if you have a claim to submit after you come home (you have 12 months to do so), or you want to check your travel insurance coverage before you go, call us at one of the following numbers:

Canada and the United States: 1 800 465-2928

Elsewhere in the world, collect: 514 286-8412

TRIP CANCELLATION INSURANCE

When making a claim, the insured must provide us with supporting documentation as quickly as possible. We will refuse any claim that is submitted more than 12 months after the date on which the expenses were incurred.

For any questions about your travel insurance, please see the brochure on that subject: Travel insurance brochure.

Many health insurance expenses can be claimed online through the Client Centre. You can also make a claim using the Beneva Mobile Services app.

It’s also possible to mail in a claim by submitting the appropriate form. A personalized version is available in the Client Centre and at beneva.ca. The bills must be paid, with the originals attached to the claim.

IMPORTANT: All health insurance claims must be received by us no later than 12 months after the date the expenses were incurred. After that, they will not be reimbursed.

You can present your insurance card to your dentist and pay the portion of expenses not covered by us.

IMPORTANT: For all expenses covered by Dental Care insurance, claims must be received by us no later than 12 months after the date the expenses were incurred. After that, they will not be reimbursed.

The assistance program puts you in touch with qualified providers who are ready to help you.

All assistance program providers belong to recognized professional orders (nurses, occupational therapists, psychologists, social workers, counsellors, etc.), ensuring that you get high-quality, confidential service. To speak with a professional, call the assistance program at 1 877 480-2240. Have your contract number on hand.

The disability insurance claim must be submitted to us no later than 90 days following the start of total disability.

To do this, you must fill out both disability claim forms (Statement of insured AND Statement of attending physician), available in the Documentation section, and submit them to us.

Note: These two forms must be submitted together.

For further information, please see the question > I recently started disability leave. What should I do to receive my benefits?

The life insurance benefit claim form is available by contacting us directly.

The claim and proof of death must be submitted to us within 90 days following the date of death.

How to modify your file

Eligible events:

- Marriage/civil union

- Cohabitation for a period of one year

- Birth/adoption/custody of a child

- Termination of spousal coverage

- Separation/divorce

- Death of a dependent

When your request is submitted to us within 30 days following the event: Your request is accepted as of the date of the event.

When your request is submitted to us more than 30 days following the event: Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible events:

- Marriage/civil union

- Cohabitation for a period of one year

- Birth/adoption/custody of a child

- Termination of spousal coverage

- Separation/divorce

- Death of a dependent

When your request is submitted to us within 30 days following the event: Your request is accepted as of the date of the event.

When your request is submitted to us more than 30 days following the event: Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

Please note:

- The increase in health coverage is accepted even if the 36-month minimum participation period is not over.

- A new 36-month minimum participation period starts on the date the change request is approved if you choose Health 2 or Health 3.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible events:

- Marriage/civil union

- Cohabitation for a period of one year

- Birth/adoption/custody of a child

- Termination of spousal coverage

- Separation/divorce

- Death of a dependent

When your request is submitted to us within 30 days following the event: Your request is accepted as of the date of the event.

When your request is submitted to us more than 30 days following the event: If your 36-month minimum participation period is over, your request is accepted on the first day of the premium payment period that coincides with or follows the date Beneva receives your request.

If you have not completed the 36-month minimum participation period, your request to decrease your coverage is refused.

Please note:

- A new 36-month minimum participation period starts on the date the change request is approved if you choose Health 2.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- Start of equivalent coverage (which, at a minimum, includes drug coverage) through a private group insurance plan

When your request is submitted to us within 30 days following the event: Your request is accepted as of the date of the event.

When your request is submitted to us more than 30 days following the event: Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

Please note

- The exemption is accepted even if the 36-month minimum participation period (applicable to Health 2 and Health 3) is not over.

To request this type of change, you must:

Fill out the Request for Change form specifying all of the required information below:

Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- Cessation of equivalent coverage under a private group insurance plan.

When your request is submitted to us within 30 days following the event:

- Your request is accepted as of the date of the event

AND - You can choose the health insurance coverage you want (Health 1, 2 or 3)

When your request is submitted to us more than 30 days following the event:

- Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request

AND - You must continue to participate in Health 2 or Health 3 if your 36-month minimum participation period has not been completed

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible events:

- Marriage / civil union

- Cohabitation for a period of one year

- Birth / adoption / custody of a child

- Termination of spousal coverage

- Separation / divorce

- Death of a dependent

When your request is submitted to us within 30 days following the event: Your request is accepted as of the date of the event.

When your request is submitted to us more than 30 days following the event: Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

Please note:

- If you add this benefit, your 36-month minimum participation period starts on the date your request to add is approved.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

WHEN YOUR 36-MONTH MINIMUM PARTICIPATION PERIOD IS OVER

Eligible event:

- No event required

Your request to terminate is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

WHEN YOUR 36-MONTH MINIMUM PARTICIPATION PERIOD IS NOT OVER

Eligible event:

- Start of equivalent coverage

You can terminate your participation during the 36-month minimum participation period if you can establish, to the satisfaction of SSQ, that you are now eligible for another group insurance plan that includes a dental care insurance benefit.

In such case, your request would be approved as of the first day of the premium payment period that coincides with or follows the date SSQ received your request.

Please note:

- If you want to obtain dental care coverage in the future, a new 36-month minimum participation period will start on the benefit’s new effective date.

To request this type of change, you must contact Beneva at 1 877 651-8181.

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva accepts your evidence of insurability.

Please note

- If you have long term disability insurance, your option selection will also increase for this benefit.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva receives your request.

Please note:

- If you have long term disability insurance, your option selection will also decrease for this benefit.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva accepts your evidence of insurability.

Please note:

- Your option selection for this benefit will be the same as for short term disability insurance.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date SSQ receives your request.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva accepts your evidence of insurability.

Please note:

If you want to subscribe to Participant’s Optional Life Insurance, you must first sign up for Option 2 ($50,000) of the Participant’s Basic Life Insurance + Participant’s AD&D Insurance for yourself.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- Marriage/civil union

- Cohabitation for a period of one year

- Birth/adoption/custody of a child

When your request is submitted to us within 30 days following the event: Your request is accepted as of the date of the event.

When your request is submitted to us more than 30 days following the event: Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva accepts your evidence of insurability for your dependents.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva accepts your evidence of insurability for your spouse.

Please note:

If you want to subscribe to Spouse’s Optional Life Insurance, you must first sign up for Option 2 ($50,000) of the Participant’s Basic Life Insurance + Participant’s AD&D Insurance for yourself.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

Please note:

- When you request to decrease or terminate one of these benefits, you can participate again, subject to Beneva's approval of evidence of insurability.

- Having Option 2 ($50,000) for your Participant’s Basic Life Insurance + Participant’s AD&D Insurance is a prerequisite for taking out additional life insurance coverage for yourself and your spouse. If your Basic Life Insurance is terminated, these two benefits must be terminated at the same time, if applicable.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

IMPORTANT: If you previously designated an irrevocable beneficiary, you must get that person’s consent to be able to make this change. To do this, use the Request to change irrevocable beneficiary form.

Otherwise, to change a beneficiary who was previously designated as revocable, you can modify it one of the following ways:

- On Client Centre

- Fill out the Request for Change form and send it to us in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request is accepted as of the first day of the premium payment period that coincides with or follows the date Beneva received your request.

Please note:

- To be recognized as a non-smoker, you must declare that you have not smoked any tobacco product, such as cigarettes, cigars or a pipe, or any drugs in the last twelve months.

- Beneva can periodically request confirmation of this status.

- If you do not respond, you will lose the status and no longer receive the lower premium as of the date of our request.

- Any false statement or non-disclosure can nullify your coverage.

To request this type of change, you must:

- Fill out the Request for Change form

- Send us your form in one of the following ways:

Email:

[email protected]

Fax:

1 866 333-7503

Mail:

Beneva

2525, boulevard Laurier

C.P. 10500, succ. Ste-Foy

Québec QC G1V 4H6

Eligible event:

- No event required

Your request will be processed as soon as possible once Beneva receives it.

There are several ways to make this change:

On Client Centre

By email:

[email protected]

By fax:

1 866 333-7503

By phone:

1 877 651-8181

There are several ways to make this type of change:

On Client Centre

By email:

[email protected]

By fax:

1 866 333-7503

You can make this change by:

Email:

[email protected]

Fax:

1 866 333-7503

Frequently Asked Questions

Yes. For a while, you may notice some items in Beneva colours and others in SSQ colours.

To learn more, browse the page about the coming together of La Capitale and SSQ Insurance: Beneva | SSQ Assurance

Yes, you must enrol.

You undoubtedly have health and perhaps also dental coverage under your spouse’s plan. It is possible, however, for you to be exempted under the RSGE plan.

But it is important to know, that your spouse’s coverage does not cover you for disability insurance in the event that you should become disabled.

It would be advisable to check whether you have life insurance coverage under your spouse’s plan and if it is adequate.

Disability

All your benefits remain in force.

Moreover, after seven consecutive days of disability, you no longer have to pay your premiums, as they are waived.

This is when your short term disability payments start.

Preventive leave/Maternity leave

You continue to have all of your benefits.

Your insurance premiums and coverage levels are established according to your situation prior to the start of your leave.

Unpaid leave/Parental leave

You must inform us as soon as possible if this type of temporary work interruption occurs.

Information sent to Beneva before your leave starts: with this type of absence, you can choose from the following options for maintaining your participation:

- Maintain your indissociable participation in all of your benefits.

- Decrease your coverage to Health 1 only and do not maintain participation in the other benefits.

Information sent to Beneva after your leave starts: You only have the option to maintain Health 1.

Your work interruption is then deemed to have started on the first day of the premium payment period that coincides with or follows the date Beneva received your notification.

Permit suspension (by the Director of Youth Protection (DYP))

During the first four weeks of suspension:

- You must maintain all of your coverage since you are still receiving a subsidy for this period.

- You must send Beneva a copy of your permit suspension letter.

After four weeks of suspension:

After the first four weeks, your only option for maintaining your coverage is Health 1. You can’t maintain your participation in your other benefits until the DYP’s final decision has been released.

If the decision is in your favour:

- You must inform us of the reopening of your childcare centre.

- All benefits held prior to the suspension are reinstated retroactively to the first day following the 4-week suspension period. The premiums are then payable retroactive to the date premiums began to be waived, if applicable

Withdrawal of accreditation by the ministère de la Famille

During the period in which you are formally appealing the withdrawal of accreditation by the Ministère, you can maintain participation in the benefits you hold. To do this, you must pay us the required premium until the final decision has been rendered.

Here are your options for maintaining coverage:

- Participate in Health 1 only.

- Maintain participation in all benefits you held before the start of the contestation period, except the short and long term disability benefits.

If the decision is in your favour:

Your participation in all the benefits you held prior to the start of your contestation resumes on the date of the decision.

If the decision is not in your favour:

Your participation in group insurance is terminated on the date of the decision.

If the Ministère de la Famille no longer recognizes you as a home childcare provider for 3 or more children, you must request to have your insurance coverage terminated.

Coverage ceases on the day the Ministère ceases to recognize you as long as Beneva receives supporting documentation within 30 days following that date. Otherwise, your contract is terminated on the last day of the premium payment period following receipt of documentation.

Before terminating your coverage, we may ask you to provide proof that you are no longer recognized by the Ministère de la Famille as a home childcare provider for 3 or more children.

When the Ministère once again recognizes you as a home childcare provider for 3 or more children, you must notify us and provide proof of eligibility, since your eligibility is no longer subject to the 3-month enrolment period.

You are then subject to the following rules, depending on when you were once again caring for 3 or more children:

- Within 30 days following termination of your insurance, you resume all of the coverage you had prior to termination.

- More than 30 days following termination of your insurance, you must select your coverage as if you were enrolling for the first time. If you had Health 2 or Health 3, Dental Care, Option 2, 3 or 4 for short term disability insurance, long term disability insurance, Participant’s Basic Life Insurance and Spouse’s and Dependent Children’s Life Insurance, you can sign up for these benefits again without evidence of insurability. However, if you waived these benefits, you must provide evidence of insurability.

In the days before your eligibility date for short term disability benefits, you must send an insurance benefit claim to us.

A list of the documents and forms required for a new disability benefit application appears below.

Important: You must have all of the documents and duly completed forms on hand, and then send the application to us in one mailing.

Disability insurance claim forms (available in the Documentation section)

- Application for Disability Insurance Benefits - Home Childcare Providers

- Attending physician’s statement

Medical documentation

- Complete medical record compiled since the start of disability, including any medical opinions

- Results of exams or tests done

- Clinical notes

- Any other medical document in your file that you deem relevant

You can send us the documents by:

Email:

[email protected]

Fax:

418 651‐5569

Mail:

Beneva inc. | Disability and Life Insurance Management

2525 boulevard Laurier, C.P. 10500, Succ. Sainte‐Foy Québec

QC G1V 4H6

Questions?

You can contact us Monday to Friday, from 8:30 a.m. to 4:30 p.m., at one of the following numbers: 418 651-2307 or 1 888 651-2307.

When you turn 65, you can maintain all of the coverage offered by your health insurance benefits, including your drug benefits, with no change to your premiums.

ACTION TO TAKE if you want to maintain your drug coverage with Beneva:

- Since all Quebec residents who turn 65 are automatically enrolled in the Public Prescription Drug Insurance Plan (PPDIP), you must contact the Régie de l’assurance maladie du Québec (RAMQ) to withdraw from that plan and avoid paying the PPDIP premium.

- You don’t need to take any action with us.

ACTION TO TAKE if you want to have RAMQ prescription drug coverage:

- In this case, you must send us an exemption request.

- You must then pay the PPDIP premium and can no longer claim expenses under the home childcare service group health insurance coverage. This decision is irrevocable.

When your spouse turns 65, you can maintain all of the coverage offered by your health insurance benefits, including your drug benefits, with no change to your premiums.

ACTION TO TAKE if you want to maintain drug coverage for your spouse with Beneva:

- Since all Quebec residents who turn 65 are automatically enrolled in the Public Prescription Drug Insurance Plan (PPDIP), your spouse must contact the Régie de l’assurance maladie du Québec (RAMQ) to withdraw from that plan and avoid paying the PPDIP premium.

- You don’t need to take any action with us.

ACTION TO TAKE if you want your spouse to have RAMQ prescription drug coverage:

- In this case, you must send us a request for change to switch your health insurance status to individual or single-parent.

- Your spouse must then pay the PPDIP premium and can no longer claim expenses under the home childcare service group health insurance coverage. This decision is irrevocable.

You are responsible for informing us within 30 days following the event that your insurance contract is being terminated because your childcare service has been shut down.

Any request received by Beneva after that period will lead to termination of your insurance contract at the end of the premium payment period following receipt of the termination request, meaning you will no longer be eligible for retroactive reimbursement of your premiums.

LIFE INSURANCE

When you are planning to retire and you are at least 55 years old, you become eligible for the FSSS (CSN) optional life insurance plan for retirees.

You can convert a maximum of $25,000 into this plan. The excess amount can also be converted into an individual life insurance contract.

HEALTH INSURANCE

Regardless of your age, you can enrol in the Privilege plan.

Get more information about this plan

For questions about the plans available upon retirement, please contact us at 1 866 777-9788.

LIFE INSURANCE

If you cease belonging to the home childcare provider group that is eligible for the FSSS (CSN) group life insurance plan, for example, because of a resignation or termination of insurance following the end of a premium waiver, you can convert your coverage amount into an individual life insurance policy without having to provide evidence of insurability upon written request sent to Beneva within 31 days following the end of your affiliation with the group, and by paying all of the first premium.

You can then obtain temporary life insurance with a term of one year that can be converted into a whole life or combined insurance policy normally offered by Beneva, or into a form of insurance required by law.

You can convert an individual life insurance amount that is equal to or less than the amount you held immediately before conversion, or equal to or less than $25,000 if you are 65 or older when the individual insurance coverage begins.

The individual insurance does not include any accident coverage or premium waiver provision.

The conversion right does not apply to AD&D insurance.

HEALTH INSURANCE

Regardless of your age, you can enrol in the Privilege plan.

Get more information about this plan

For questions about the plans available upon retirement, please contact us at 1 866 777-9788.

The most efficient way is to log in to your Client Centre. It has a copy of your card with all the relevant information.

- First things first

To create your account, you’ll need an email address and your certificate number (it’s on your insurance card). - Create your account

Head over to our website or mobile app to start your registration. - Follow step-by-step instructions

Enter the information requested on each screen. And that's it!

See the section How to modify my coverage and information in my file for all the information required.

Yes, your dependent child who is on sabbatical school leave can maintain their dependent status as long as:

- The child is between 18 and 25 years old

- A written request is sent to Beneva before the leave starts

- The request must state the start date and length of the sabbatical leave

Sabbatical leave is approved only once in a lifetime for each dependent child.

The sabbatical leave cannot exceed 12 months, subject to RAMQ eligibility, and must end at the start of a school year or term.

You are not required to inform us before you leave on a trip.

However, if an insured (you or one of your dependents) has a recognized illness, before leaving they must make sure that they are in good health, the condition is stable, that they can do their regular activities, and that there are no symptoms that reasonably suggest that complications could arise or care could be required while outside their home province.

Prior to leaving, the insured person must check whether their state of health limits their coverage in any way.

For further information, to request authorization before incurring or paying eligible expenses, or to request assistance, the insured person can call our travel assistance service:

Canada and the United States: 1 800 465-2928

Elsewhere in the world, collect: 514 286-8412

The contract number on your insurance card must be provided when the call is made.

TRAVEL INSURANCE AND ASSISTANCE

The expenses covered are the expenses incurred by the insured person subsequent to a death, accident or sudden and unexpected illness that occurs while travelling outside the home province and requiring emergency care. Travel assistance coverage provides various services to assist an insured person who is experiencing such events.

TRIP CANCELLATION INSURANCE

Pursuant to the terms described in this benefit, we pay the costs incurred by the insured person subsequent to the cancellation, interruption, extension or change to a trip as a result of one of the eligible causes described in the travel insurance document available in your Client Centre, as long as the costs incurred are related to prepaid travel expenses. At the time of purchase of the trip and subsequent payments, the insured person must not be aware of any situation whose aftermath could reasonably lead to the trip being cancelled, interrupted, extended or changed.

For further information, please consult the travel insurance booklet.

Please note that luggage is not covered under this benefit.

To exercise your right to opt out, you must show that you and your dependents are covered under another private group insurance plan that includes similar drug coverage.

Spouse means persons:

- who are married or civilly united and living together;

OR - who are living as if they were married and are the father and mother of a same child;

OR - of the same or opposite sex who have been living as if they were married for at least one year.

However, dissolution of the marriage by divorce or annulment or annulment of the civil union causes the status of spouse to be forfeited, as does de facto separation for more than three months in the case of a common-law spouse. The insured who is not living with the spouse can designate another person to replace the legal spouse if this person meets the other provisions of this definition.

A child of the participant or their spouse or both, who is not married or in a civil union and who resides or is domiciled in Canada, who depends on the participant for their maintenance and meets one of the following conditions:

- is less than 18 years old

- is less than 25 years old and is attending school full time and enrolled at an accredited educational institution

- regardless of the child’s age, being totally disabled while they met one of the above conditions and has remained continuously disabled since then

- regardless of the child’s age, is a single adult who has a functional impairment defined in the Regulation respecting the basic prescription drug insurance plan, an impairment which must have occurred before the child reached the age of 18, who receives no benefits under a last resort assistance program stipulated in the Act respecting income support, employment assistance and social solidarity, who is domiciled with the participant and is a person over whom the participant or spouse exercises parental authority or would exercise it if the child was a minor

Also considered a dependent child is an unmarried child over whom the participant or spouse exercises parental authority or would exercise it if the child was a minor.

Moreover, a dependent child who is on sabbatical school leave maintains their status as a dependent child as long as the participant fulfils the criteria described in section 7.13, Dependent child on sabbatical school leave, in the group insurance booklet.

The term “dependent child” also applies to any child who has been legally adopted or for whom legal adoption procedures have been initiated, or for whom a placement order has been issued in compliance with the conditions for adoption.

Premium Calculator

Premium Calculator

Evaluate the cost of the various coverage available to you

Documentation

Questions?

If you are dealing with a specific situation or need help creating your Client Centre account, you can contact Customer Service, Monday to Friday, from 8 a.m. to 8 p.m.

Phone: 1 888 651-8181

Email: [email protected]

Discover our app!

Your insurance on the go.

Application mobile disponible sur l'Apple App Store

Application mobile disponible sur l'Apple App Store  Application mobile disponible sur le Google Play Store

Application mobile disponible sur le Google Play Store

La Capitale and SSQ Insurance become Beneva

Make yourselves at home

Loading...